Market Commentary | November 4th, 2024

Week in Review…

With this past week being the last full week before investors go to the election polls, labor market numbers and inflation were the focus as markets struggled to overcome a surprise in payroll numbers.

- The S&P 500 fell 1.37%, continuing a two-week negative streak

- The Dow Jones Industrial Average was slightly negative at 0.15%

- The Nasdaq finished the week down 1.50%, snapping a seven-week positive streak

- The 10-Year Treasury yield ended the week at 4.38%

This last week was an important week as market participants updated their forecasts and debated the direction of the economy and interest rates alike. Looking back, the data released last week can loosely be grouped into three buckets: labor, economic/inflation, and earnings data.

The reports pertaining to the labor market last week seemed to indicate a solid labor market. The biggest headline from last week was the Bureau of Labor Statistics’ Nonfarm Payroll report that fell significantly short of expectations. However, this report was quickly written off as noise due to hurricane disruptions and union strikes. This consensus has been validated by a host of supplemental and surrounding data. For example, ADP Nonfarm Payroll showed a significant number of jobs had been added during October. Also, surrounding data like initial jobless claims, continuing jobless claims, and average hourly earnings all exceed expectations. Furthermore, the unemployment rate remained unchanged at 4.1% as well. The only miss was the Job Openings and Labor Turnover Survey (JOLTS) report on Tuesday. In aggregate, the labor market appears to be on solid footing.

Last week also provided a chance for markets to evaluate the directional trends in the economy and inflation. On Thursday the Bureau of Economic Analysis preliminary Q3 gross domestic product (GDP) showed the economy may be cooling, as GDP was 2.8% quarter-over-quarter compared to an estimated 3%. On the other hand, demand within the economy appears to be robust with pending home sales and crude oil beating estimates by a wide margin. Thursday’s Core Personal Consumption Expenditures (PCE) report showed inflation remains stubbornly above the Fed’s 2% target at 2.7%. Both economic activity and inflation are important inputs for nominal yields and as a result of last week, the market will have to navigate pricing treasuries with somewhat mixed signals.

Finally, earnings were strong for most of the mega cap stocks last week. Microsoft, Google, Amazon, and Meta reported earnings beating estimates. Trading for the week was mixed as markets priced in management’s forward guidance. Apple was the lone mega cap that was unable to beat estimated earnings. All in all, earnings continue to be strong.

Spotlight

A Look at Q3 Fund Flows

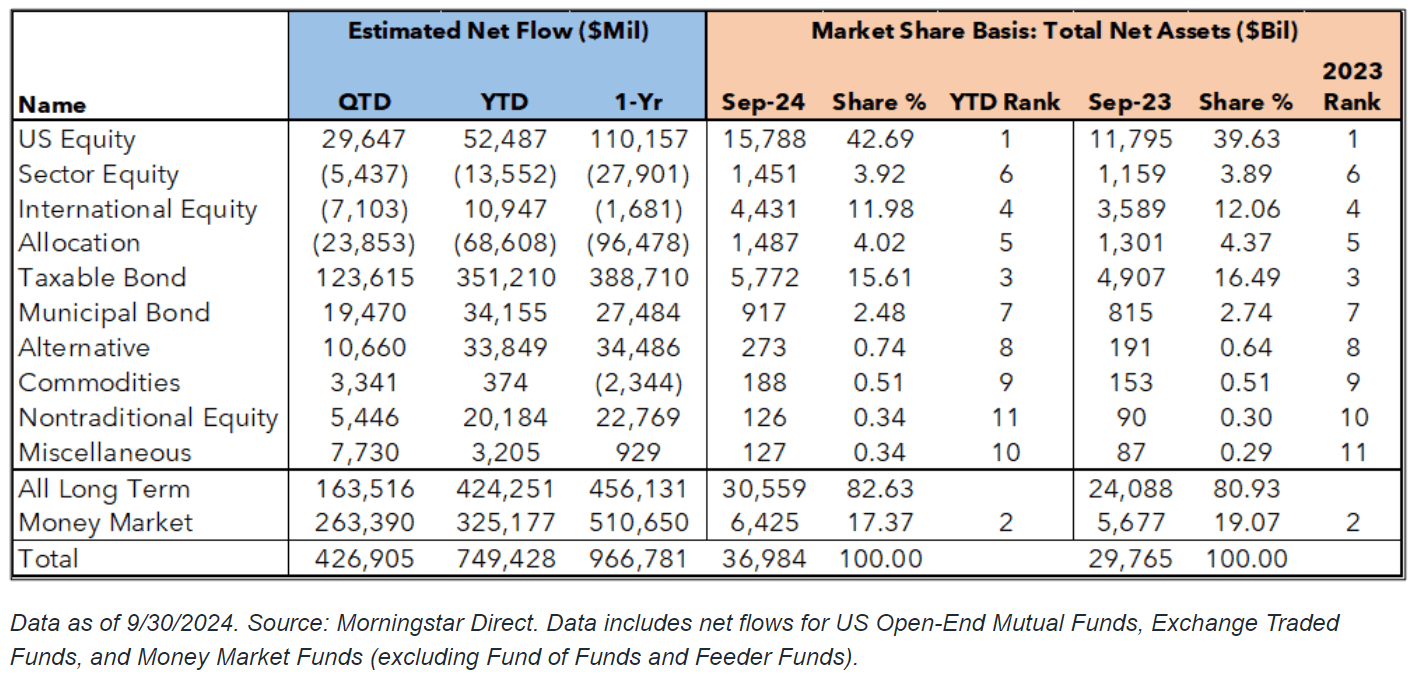

As we move into the last quarter of the year, we take a look at fund flows and see how investors are allocating given equity valuations and potential future rate cuts on the horizon. Year to date (YTD), we continue to see investors move from U.S. equities into fixed income broadly in both taxable and municipal bonds.

Overall, the total net flow across all categories for the year was $749,428 million, indicating robust activity in the investment landscape. Taxable Bonds has had a YTD net flow of $351,210 million, leading all categories. Over the past year, the net flow reached $388,710 million, reflecting strong investor interest given valuations in equities as well as potential rate cuts in the future. Compared to September 2023, the market share slightly decreased from 16.49% to 15.61%. Despite this small decline, Taxable Bonds remain a significant category in the market and rank third behind equities and money markets.

Equities have had a more U.S.-dominated year so far. In September 2024, U.S. Equity had a market share of 42.69% with a YTD net flow of $52,487 million, while International Equity had a market share of 11.98% with a YTD net flow of $10,947 million. Compared to September 2023, U.S. Equities’ market share increased from 39.63% to 42.69%, and International Equities’ market share slightly decreased from 12.06% to 11.98%.

Regarding cash, Money Market funds had a YTD net flow of $325,177 million, reflecting their continued popularity among investors. With a market share of 17.37%, they remain a significant portion of the investment landscape. Despite their substantial inflows, Money Market funds still represent cash on the sideline, indicating that many investors prefer to keep their assets in liquid, low-risk investments given market valuations and concerns around the election.

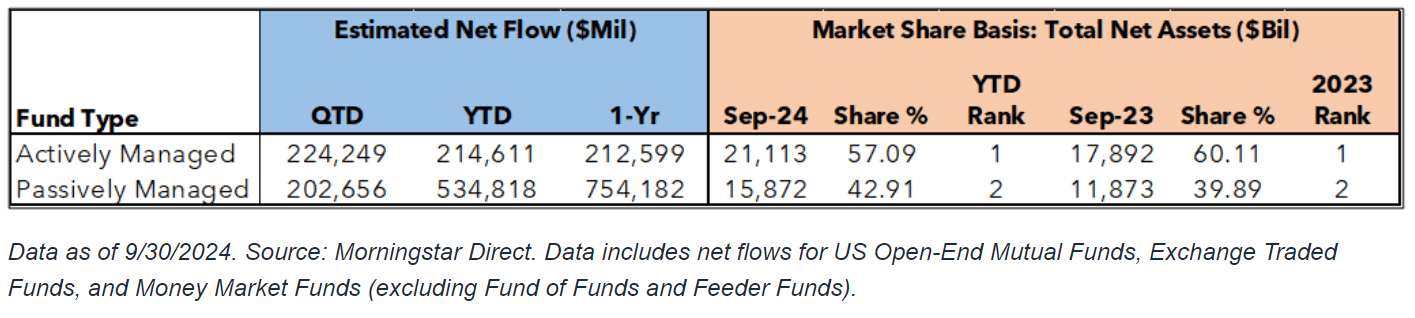

In September 2024, Actively Managed funds had a YTD net flow of $214,611 million and a market share of 57.09%, maintaining their top rank. However, this is a decrease from a quarter ago when actively managed strategies experienced significant outflows, reversing the revitalization seen in 2022 and 2023. Passively managed funds, with a YTD net flow of $534,818 million and a market share of 42.91%, have continued to attract more investor interest, reflecting a growing preference for passive management strategies we have seen over the last decade.

Compared to a quarter ago, where passive strategies saw $605 billion in inflows over the past year, the trend has persisted with substantial inflows in 2024. Despite actively managed funds holding a larger share of total net assets at $19.4 trillion compared to $13.8 trillion for passive funds, their market share has fallen below 60% year to date. This shift is likely due to investors favoring lower cost indexing versus higher cost active management within traditional asset classe

Week Ahead…

Next week’s economic and market review centers around the anticipated rate cut and its implications on market sentiment, against the backdrop of the upcoming election. With the election approaching, markets have been cautiously optimistic, as investors are gauging potential policy changes while closely tracking economic indicators. While political uncertainties often create short-term volatility, the market appears relatively stable as of now.

The Federal Reserve is widely expected to implement a 25 basis points (bps) rate cut next week, following a 50 bps cut during their September meeting. This expectation reflects a trend of slowing inflation and slightly softer-than-expected GDP growth over the past couple months, which has signaled to the Fed that a moderate easing could help sustain economic momentum. However, expectations for a more aggressive 50 bps cut remain low, as recent data, such as the ADP jobs report, show no signs of a significant economic downturn. Job market resilience and improving consumer sentiment over the past quarter underscore the Fed’s current strategy of gradual adjustments rather than abrupt rate cuts.

As we approach the year end, market expectations align closely with the Fed’s own projections released during September, where a cautious yet steady path was indicated. The market is pricing in a high likelihood of another 25 bps rate cut during the December meeting, barring any sudden economic changes. Investors are already factoring in this anticipated rate trajectory, which could bring further stability to equities and bonds. As a result, markets may see modest gains if the Fed’s actions next week align with these projections, providing a smoother close to the year as rate adjustments become more predictable.

This content was developed by Cambridge from sources believed to be reliable. This content is provided for informational purposes only and should not be construed or acted upon as individualized investment advice. It should not be considered a recommendation or solicitation. Information is subject to change. Any forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The information in this material is not intended as tax or legal advice.

Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Socially responsible investing does not guarantee any amount of success. Clients and prospective clients should be prepared to bear investment loss including loss of original principal. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is not a guarantee of future results.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The S&P 500 is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The NASDAQ Composite Index is a market-value weighted index of all common stocks listed on the NASDAQ stock exchange.