Broad equity markets finished higher for the week, which was relatively light in terms of economic releases.

- The S&P 500 was up for the week gaining 1.85%

- The Dow Jones Industrial Average was up at 2.16%

- The Nasdaq Composite finished higher by 1.14%

- The 10-year Treasury closed at 4.50%

The Conference Board released the Employment Trends Index for the month of April. Recent readings have shown a persistent bearish labor market trend due to consecutive decreases in monthly readings. Additionally, initial jobless claims for the week were released. The reading was forecasted at 212,000; however, it came in at 231,000 initial claims, indicating a bearish trend.

Changes in outstanding consumer credit for the month of March were released by the Federal Reserve Board (FRB). Consumers in March had very little impact on their outstanding credit according to the FRB’s recent reading. Furthermore, the University of Michigan released their Consumer Expectations Index for the month of May, gauging consumers’ expectations of a potentially cooling economy.

Weekly crude oil inventories were released by the Energy Information Administration (EIA), suggesting a possible decline in the price of oil due to weaker than anticipated demand. Additionally, the weekly U.S. Baker Hughes Total Rig Count depicted two fewer active rigs than the previous week, possibly correlating to the decrease in demand. This reading is now the third consecutive week showing a decrease in the number of rigs. Economists will be watching to see if this trend continues.

Corporate Bankruptcies Heating Up

At the start of the year, companies were optimistic about interest rate cuts as early as March. As economic and inflation data began rolling in, that optimism began to go away. The CME FedWatch Tool is currently not expecting interest rates to be cut until the second half of the year. With high borrowing costs, corporate balance sheets have taken a heavy toll. Presently when corporations issue or refinance debt, they have to issue debt with significantly higher yields than what they were used to. This is especially cumbersome for “zombie firms” that don’t have cash on hand to service their debt.

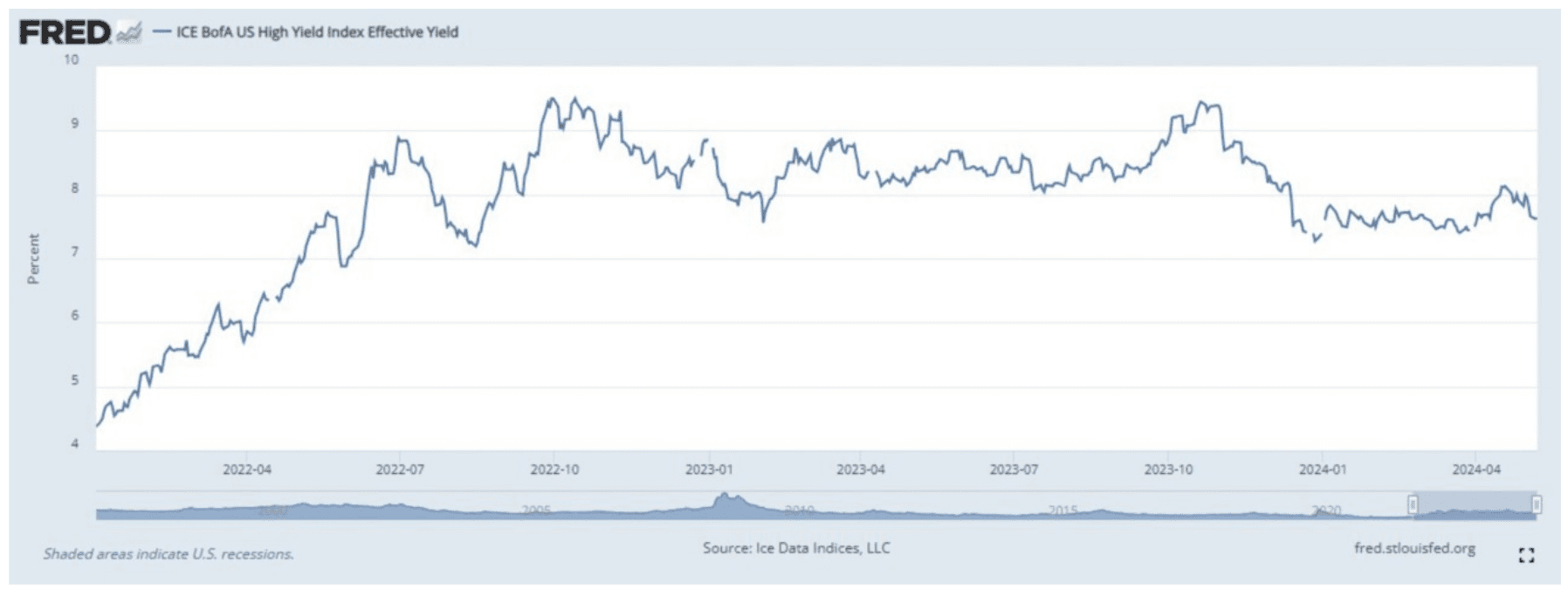

For some firms, the cost of borrowing has doubled or tripled over the past couple of years. Effective yields for below-investment grade corporate debt as measured by the ICE BofA U.S. High Yield Index have soared since the beginning of 2022.

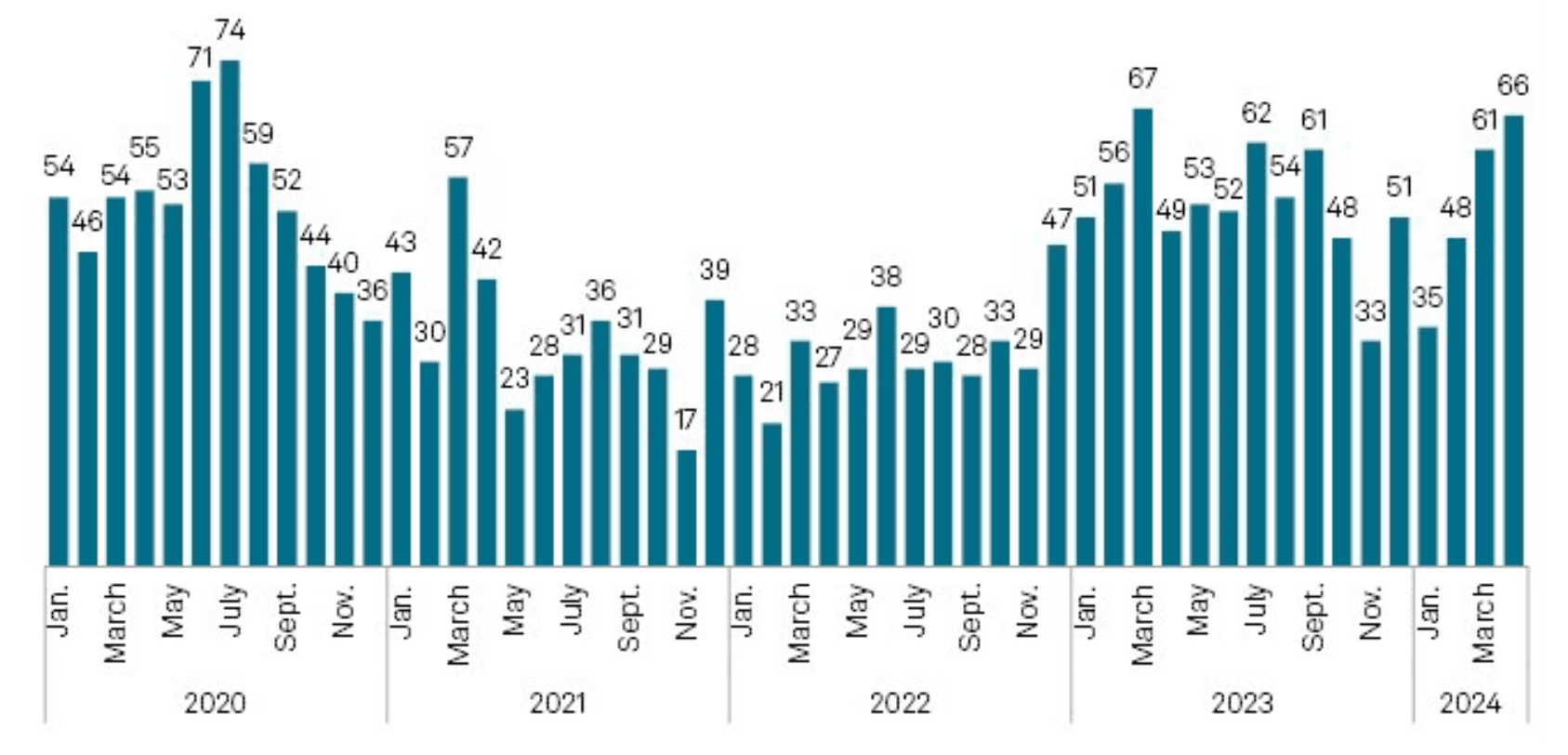

S&P Global recently published the number of U.S. companies that filed for bankruptcy in the month of April. The report showed that 66 companies filed for bankruptcy, compared to 61 filings for the month of March. This was the highest level since March of 2023. This is particularly interesting because 2023 was an outlier year. Prior to March of 2023, which reached a level of 67 filings for the month of April, that level had not been reached since July of 2020. Corporations are losing optimism and have begun to throw in the towel.

US bankruptcy filings by month

Source: S&P Global Market Intelligence

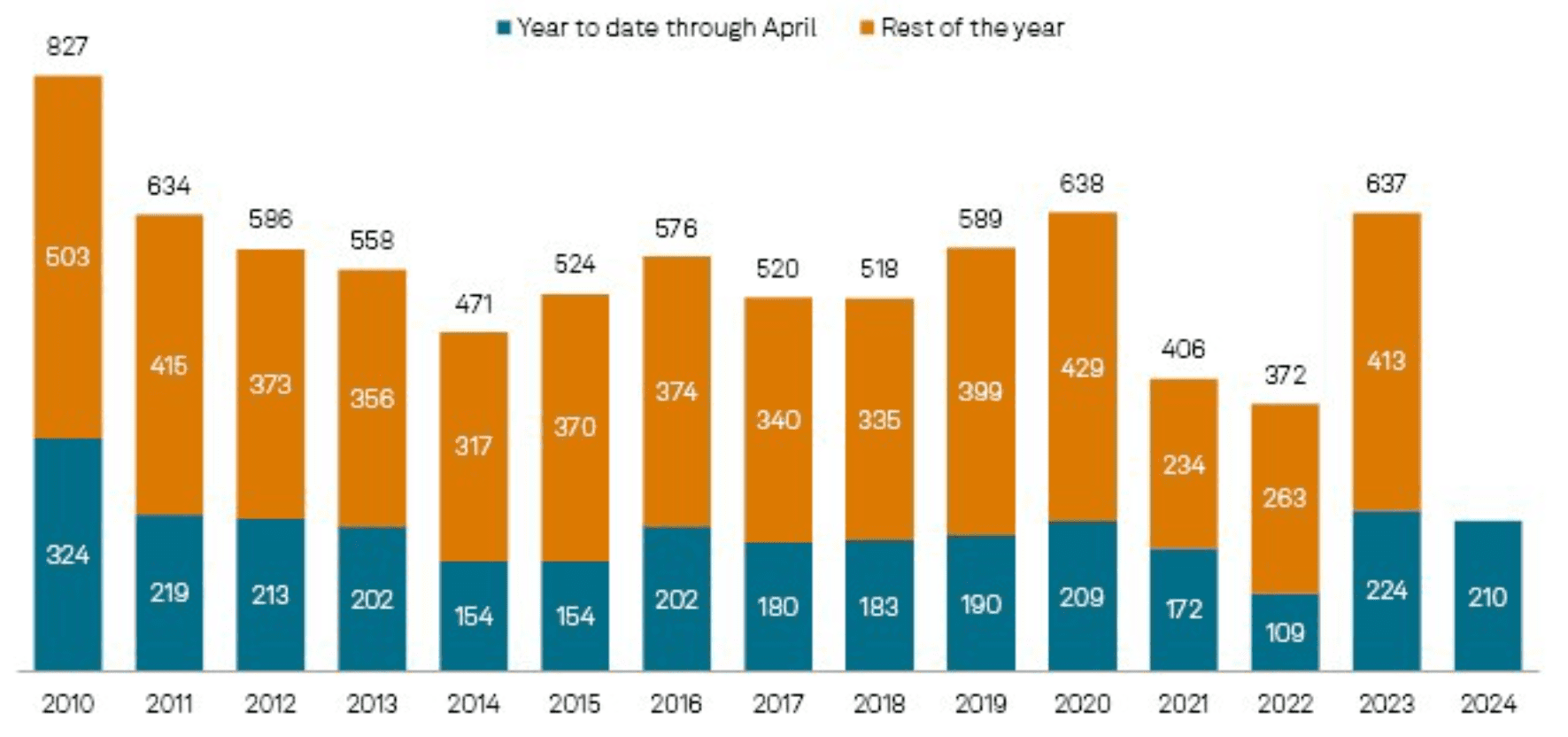

While this may sound alarming, when placed in historical context, the number of filings is not significantly different from normal levels. The number of firms filing for bankruptcy has exceeded 200 in the first four months of the year on seven occasions since 2010. The year-end figures for these instances varied widely, ranging from 827 in 2010 to 558 in 2013.

US bankruptcy filings by year

Source: S&P Global Market Intelligence

Out of the 66 filings in April, the three that stand out are: Express, Number Holdings, and ConvergeOne Holdings. All three of these companies had more than $1 billion in liabilities as of the date of their filings. Express is a clothing retailer that filed for bankruptcy on April 22 to pursue a sale to WHP Global. Number Holdings is the parent company for the 99 Cent Only stores, and ConvergeOne Holdings is an information technology company focusing on managed cloud, cyber security, data centers, and software.

In terms of sectors, consumer discretionary, healthcare, and industrials now lead all sectors for the year with all three sectors having over 20 companies file for bankruptcy.

On Monday, consumer inflation expectations will be released. Inflation expectations have consistently stayed at 3% each month since January 2024. Economists will be watching to see if this trend continues.

Tuesday, the Producer Price Index (PPI) will measure the change in the input costs of goods and services. Rising input costs could impact consumer prices, making the overall cost of goods and services rise as well. Currently, May’s PPI is predicted to be at 0.2%, matching April’s reading. Additionally, the Consumer Price Index (CPI) for the month of May, which measures the change in the prices of goods and services will be released on Wednesday. Currently, economists are forecasting a 0.3% change in prices.

Rounding out the week, building permits from April will be released, setting the foundation for future housing starts. Recently, there has been an increase in the number of building permits, indicating a possible bullish housing market. Additionally, the Philadelphia Fed Manufacturing Index will be released for the month of May, measuring an increase or decrease in working conditions. Readings since February have shown improving conditions each month.

This content was developed by Cambridge from sources believed to be reliable. This content is provided for informational purposes only and should not be construed or acted upon as individualized investment advice. It should not be considered a recommendation or solicitation. Information is subject to change. Any forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The information in this material is not intended as tax or legal advice.

Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Socially responsible investing does not guarantee any amount of success. Clients and prospective clients should be prepared to bear investment loss including loss of original principal. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is not a guarantee of future results.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The S&P 500 is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The NASDAQ Composite Index is a market-value weighted index of all common stocks listed on the NASDAQ stock exchange.